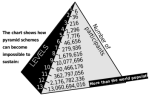

Is CBDC the new form of slavery?

The CBDC (Central Bank Digital Currency) is being rolled out, its time to think of the potential consequences. We will not even go into the privacy issues, which has been covered in great detail, but rather touch up on the consequences (intended and unintended):

Usefulness

For the uninitiated, what the CBDC does is have your currency digitally (it is same as having 5 x 100 rupees, 2 x 500 rupees, but digitally). To pay Rs 575, you pay one 500, one 50, one 20, one 5 – all digitally. If you are wondering, is it not easier to just online pay, use a card or account transfer the Rs 575? Yes, you would be absolutely right! It is much simpler, easier to do so. So, if CBDC is not about new capabilities or convenience, then what is it about?

Control

Yes, control! Every single transaction can now be tracked and controlled. The Big Brother can now determines what you can buy, what you can eat, where you can travel, how much you can spend on medicine or your kid’s education.Personal Priorities vs Centralized control

As an exaggerated example, consider that you are sick and in hospital, not having received your salary for 2-3 months and don’t have much money. Your property tax is due and your local municipality, in its authority decides to auto-debit the CBDC linked to the PAN card? You are left with no money for medicine or treatment and your family with no food. Think about it.

Negative interest rates

As we all know the powers that be are wont to come up with new rules, as Japan did several years ago, to create negative interest rates. For the uninitiated, a negative interest rate of 5% means, you lose Rs 5 every year for keeping Rs 100 in your bank (just as positive interest rate means, you get paid Rs 5 every year).

Why is this done? In the case of Japan, ostensibly, to increase spending, boost consumption and drive the economy. You may ask, has it worked? No, it hasn’t made any difference in a decade and that is not for lack of trying! Japan is still in deflation, just as its government keeps printing new money, runs a huge deficit and takes money off of savers. Unrelated to this topic, Japan has the highest suicide rates of any country in the world.

Conclusion

In the end, CBDC is not about convenience or accountability (there are existing mechanisms to do this). It is all about control. It seems to be a new form of slavery, a modern day colonialism. After having won our

freedom from the British in 1947, it would seem, we are about it to give it up! Think about it. Talk to people in power that you know and hopefully, convince our government and bureaucrats to takes the right decision and scrap CBDC.

As Schwab famously said “Give me control of the money, I care not who runs the nation”. In their infinite wisdom, our bureaucrats and politicians may feel they would be the ones to wield this power, and retain control of this genie, and this would somehow remain benign. But in all probability, they are themselves being used to usurp this power, so it can eventually be usurped by others, higher up the food chain. It has all the hallmark of a new colonialism, that would make the British colonialism of India, a walk in the park. Everyone, including the elites and political class may end up being a slave to the neo-colonizers. Time to beware and think very hard.

There is a new CEO in town!

I must say, PM Modi’s talk on I-day was impressive. It was more a CEO talk, than that of a politician’s! The scrapping of the planning commission from the 1950’s to be replaced with a more modern organization. Setting up SEZ’s around ports (instead of a 0.25 acre wherever a politician or his kin had land and changing the laws to force actually productive export companies to “rent” them to get tax benefits). Trying to drive development from the state to the centre! It is heartening to finally see someone take the initiative to move things forward. Even a jaded Sir. K. Sam, is more optimistic!!

However, one hopes, the run towards growth will be guided by responsible policies towards environment, tackling corruption and inclusive growth. In a earlier post I have written about pollution and how regulatory authorities tied down by corruption or apathy, weren’t doing much. If that part is not fixed, along with growth, we may be looking at cancer cities like those that dot the periphery of some of the larger industrial towns in China.

A justice system rendered impotent.

There was an article today that 3 people were killed over a long running property dispute. This seems to be the 4th such news I have read in as many months.

To me, this seems to be the outcome of a new age society working with a stone age system. It seems obvious that a timely resolution by due process of law and a proper court system would have prevented this tragedy and also stop “Kangaroo courts” from operating in parts of the country trying to peddle justice to the frustrated masses.

It is no secret that the court system in our country is glacial, taking on an average 8 and in some cases 25 years or more to deliver justice. When the law of the land just doesn’t move (or takes too long), this is the obvious outcome.

For any civilized society to function properly, the justice system should work and work in a timely manner. Our failed system is equally culpable, if not more. I am no expert, but some “commonsense” solutions:

- Prevent fraudulent and invalid cases from clogging the system in the first place.

- It is no secret that a huge proportion of civil disputes in the country are property and tenancy related. There should be a barrier to entry, where some very basic facts & proof are checked by a competent person before admitting a case (a.k.a “Case Discovery”). In the absence of this, there is a huge incentive to file a case just to get time or use it as a tool of harassment.

- Once a case is filed, setup an automatic case calendar (like in US systems). The maximum dates & the case calendar are sent to both the lawyers as soon as the case is filed and they cannot delay it beyond a point or risk losing the case (and their licenses)

- Remove Archaic laws

- Things that are framed under the British rule or during early independence and are no longer valid should be scrapped. A separate body should be constituted to do this.

- Do not allow appeals unless fundamental facts have changed

- There was a news article recently about a tenancy dispute case that went all the way to supreme court and settled after 22 years. The lower courts have given their verdict in favor of one party. High court upheld it, but it still went to the supreme court. At one point, apparently, the parties were arguing about “willful default” and how to interpret the word “willful” based on a particular dictionary!! The common man might be forgiven for scratching his head and asking why the heck does it matter why he didn’t pay, so long as he didn’t pay? The courts should have a clear mandate to not entertain any appeals unless something fundamental has changed (a new fact or new evidence) can be shown conclusively and should impose penalties if it proved that the appeal was brought without one.

In the absence of that, even the best laid out laws are impotent and our system little better than a banana republic.

Will the next government (hopefully a new one!) take note?

Too much of a good thing?

Not too long ago, currency devaluation was looked at as a good thing. GOI went to great lengths to keep the rupee low to make it favorable for exports. In 2011, when rupee appreciated to 43 to USD, RBI intervened, saying that an appreciating rupee was bad for exports and the economy. We prefer a lower rupee to boost exports.

But, at 54 to USD, everyone was worried of a currency problem. At 67, it was a full-blown currency crisis! If one had listened to the words of our “great economists” in 2011, they could be forgiven for expecting the rupee slide to 67 to have increased exports by 30-40%. On the contrary, exports went down during that time. If a weak currency was the key driver for exports, Zimbabwe and many African countries would have been export powerhouses a long time back!! But, one can safely assume that the lesson will be lost and the “experts” would repeat the same message a decade from now.

What is not common knowledge is what the RBI did (or how it went about doing it) in the intervening time. In 2011, the RBI decided to take 50% of all dollar holdings of all Indians. The rational was that rupee was not a free floating currency, so the RBI can do this simply by sending a notice to all banks asking them to convert 50% of all $ holdings of all companies and individuals within 30 days. The writing on the wall was immediately apparent. Six months later, the 50% became 100%. Another 6 months later came capital controls (albeit with very different and supposedly palatable names).

Coming back to our original point, there was a time when governments willingly devalued currency as a good thing. As Brazil and now India (and soon Japan will) realize, that currency devaluation is too much of a good thing! Although a weaker currency, in the short run, may increase exports and create an illusion of prosperity, its impact on the overall economy and the general populace, is rather negative.

How deep is the river? Oh, its only chest high for a duck!

The Cancer Within

A lot of parasites do not kill their hosts. A virus is a good example, that just trys to live off of its host without killing it and when beaten down, jumps to a new host for survival. In contrast, cancer (even thought, technically it is the host cell itself and not a parasite) converts other host cells, ends up killing the host and thereby kills itself. One of the scariest scenarios painted by authors of medical fiction is a cancer that is communicable! One that jumps to a new host just before killing its previous host to continue its survival, and the trail of destruction.

Now hold that thought for a minute.

A government or bureaucracy, by definition, does not produce anything. The only source of income is tax or inflation. That, to me, seems to fit the definition of a parasite. Now add to that the rampant corruption that begins with the buying of votes and the chain reaction that this dance of democracy sets off. When the nod-nod-wink-wink corruption turns into you-cannot-do-this-without-paying extortion, it chokes off the host and when this happens in a systemic way, the productive class dwindles and there is a large feeding parasitic population. Eventually it will destroy the cancer, but the host will die with it too.

MOPSOTHCRDR

(Actual Photo, Shot at location)

(Actual Photo, Shot at location)

In spite of a healthy participation from private sector in some of the government agencies, the bureaucracy is destined to make everything just that much more harder, that it takes away the time of people from other productive tasks (not that the common man is expected to have any productive use for his time).

The once in a decade dance with bureaucracy to renew my passport started earlier this month! The new systems and processes seem quite impressive, until one hits the actual wall of bureaucracy. Once in the system, a series of paperwork for things deemed necessary by the invisible hand!

If you had changed your address in the 10 intervening years from your last passport, then tough luck. Proof of address? Driving license is not considered a valid document for any purpose! Submitting a bank statement? Make sure it is original. We don’t believe in e-statements and paperless office. Get everything in original, with 3 copies!! If not, get everything notarized or attested. Now, go away. And while you are at it, get Annexure B, C, H, L…..

After the 3rd visit I was finally allowed to enter the hallowed portals where the actual bureaucrats sit. Every single one of the Granting Officer was (and I am not making any of this up) a grumpy, tired old woman, close to retirement, who would rather be anywhere else. The one I was assigned to asked me to open and hold the file – we get so many people, you expect us to open each of the files ourselves? Open it and hold it for me to see. Now hold it down, while I put the seal. Keep it in this bunch, I can’t bend down. Then silence.

If you do not get any further response, it means your audience has ended and you can move away.

I politely suggested that she should talk to the government about outsourcing this part of the job also to private agencies (like the rest of the process, which seemed to be working better!). I got a glare that could burn through steel and quickly scurried away.

And in case you are wondering what the heck “MOPSOTHCRDR” has to do with this whole thing, that is the very descriptive description that will actually appear on your credit card statement for paying to take up the appointment. For some strange reason, it seems entirely appropriate!!

Welcome to India.

Points to Ponder

Ashok Khemka: Robert Vadra falsified documents for Gurgaon land |

And the only question on everyone’s mind is: “is that Priyanka’s bag in the background?”

| White House Overturns Trade Ruling Involving Apple: http://www.npr.org/2013/08/05/209097981/business-news Apple patent wins could mean U.S. import ban for Samsung. |

When Samsung gets a ban on sale of iPhones, by the International Trade Commission, the White house personally intervenes to get it overturned (citing among other reasons, a lack of alternative for consumer). But, When Apple successfully blocks Samsung, no word from the top – where is the consumer alternative (especially, cheaper consumer alternative) now?

Ford famously said, “we’ll give you a car in any color, so long as its black”. Maybe that holds good for fairness too!

| Secure Email Provider Lavabit shuts down under US pressure: http://www.zdnet.com/snowdens-privacy-oriented-email-provider-shuts-down-under-u-s-government-pressure-7000019185/ Levison wrote “I feel you deserve to know what’s going on – the first amendment is supposed to guarantee me the freedom to speak out in situations like this. Unfortunately, Congress has passed laws that say otherwise. As things currently stand, I cannot share my experiences over the last six weeks, even though I have twice made the appropriate requests.” |

My comments: See, I am being discreet and not commenting. So don’t shutdown this blog, ok? 😀

The Chinese conundrum!

To an astute political observer the problem is immediately apparent – India just does not know how to deal with China. Even a casual observer who had any contact with China will not fail to see it soon – to the average Chinese person the “face” is a very important part of any relationship. What is said in public and media matters a lot more than what is discussed in private.

Pakistan had used this to the maximum and has a great relationship with China. India, on the other hand, is still a world away from developing a close relationship. Our top leadership disparages them in the media and then try to be very cordial in private meetings – if they do it the other way around, things will be a lot more effective. It should have been easy to figure out, but for some unfathomable reason, it is not – even after several decades.

I happened to be China when Li Keqiang was in India. The Chinese media was touting it as the real deal. Schools were hoisting Indian flags next to Chinese flags and there were talks in the local media about teaching Hindi to Chinese children. Contrast this with the Indian media where there were headlines from the likes of Firstpost screaming “Li Keqiang visit to India was nothing more than a PR exercise”.

Seriously, what more do we want? Have their top leadership move to Delhi with their families and live there? Sit with prospective businesses to fill out forms? Once a policy decision has been made to make business easier, the welcome speech is a cue, for us to leverage it and do the actual business!

Did I mention that our External Affairs minister mentioned to his Chinese counterpart (again, if I might add) that the balance of trade was very much in favor of China and China needs to do something about it? Unless China was imposing import restriction on any goods or services from India, the onus is on us to do something to increase exports! Anything else is like the class loser asking the topper to fix his being the loser.

I am not sure why this simple logic eludes our top political minds. Provide the right infrastructure, provide electricity, help make local businesses competitive and they will produce and export products and that will fix the trade imbalance. It really is that simple!

Things are, of course, far from perfect in China. The restriction on everything from WordPress to Facebook and restrictions on even specific search terms eventually throttle productivity. And, that is an edge India may have – if our political leadership wakes up to the rest of problem and fixes it!!

Let me give another example. Chengdu is a tier II city in China, only known for its spicy food and pandas till the 90’s. A city delegation had visited Bangalore in the mid 90’s with the mission “to make Chengdu the Bangalore of China” – seriously, its still on their official manifest!

Fast forward twenty years and Chengdu looks like a million years ahead of Bangalore. With great infrastructure, a supportive government policy for technology companies, well planned universities and training programs to boost manpower, it is no wonder several hundred of the world’s largest technology companies have a base there.

They have direct flights to most parts of the world (and even a direct flight to Bangalore, they still call a ‘sister city’) and they are working to make it even better.

Bangalore? We are still figuring out how to clean our garbage.

RTF – its not what you think!

RTF – the Right to Food is the latest populist bill passed by our GOI. Noble as its intentions are, it is another hare brained scheme that will end up costing the nation a lot!! It will not only not benefit its intended audience, but will also end up raising prices across the board. Allow me to explain….

Firstly, I don’t believe governments should have their hands in anything that the free market can solve a whole lot better. Even the best run governments are inefficient – diverting resources, consuming huge overheads and bogged down by bureaucracy. With that in perspective it doesn’t take much to figure how our GOI will fare. In case it does, we have our PDS (Public Distribution System aka “Ration Shops”) as a case study. Every year millions of quintals of wheat are left to rot and to feed the rodents while millions go hungry – not to mention the level of corruption and mismanagement in the system. Imagine what would be brought to bear on the same PDS which will be tasked with procuring and distributing wheat and rice to the entire population that will come under the Food Security bill.

Secondly, this will lead us directly down the path of high food inflation – from a) the government buying the commodities with money they don’t have and b) the real problem being scarcity rather than redistribution (see The Economics of Exploitation for more on this). So, not only will the intended recipient not get access to quality food in any meaningful way, the entire citizenry would also pay a high price (quite literally) for their food.

The root cause of the problem is that farming today is not profitable. Most farmers drown in debt and are committing suicide. What profits are there are made by middle-men. Starting with an already fractured land bank, which keeps dwindling with the oligarchs of our country acquiring them for industries and “SEZs”, to lack of a formal system to advance loans to small farmers and collect it back, to a lack of a proper supply chain, the list of problems with our agricultural economy is enormous. From being an agrarian society, it has come to a point where the last outgoing RBI governor had warned that the next crisis in India might be an “agricultural crisis”.

The way to fix this is for the GOI to incentivise this sector – no, not by providing a subsidy, but by making it easy for the farmer to again pursue it as a real vocation. To make agriculture a real employment and wealth generator that a generation of educated, technology savvy entrepreneurs will look at it as a profitable venture – and then, let the free markets do the rest!!

Once the supply increases, not only will the general population be able to afford rice & wheat like the food bill envisions, but the new economy will generate enough jobs and income that they can afford dal and chicken as well! Incidentally, the rising employment will reduce the government’s NREGA rural unemployment subsidy cost!

Elections are not known to be won on logic and good economics, so it remains to be seen if better sense & sensibility prevails.

Argentina’s chimera!

“Argentina Freezes Prices to Break Inflation Spiral“ reads a recent news.

Inflation in Argentina is currently averaging 30% a year. But, if it were so simple to stop inflation with a Government decree, every government on earth would have done it already! Why would a vendor freeze price when his input costs are going up? Why would a business incur loss on every sale? Instead they would just not sell – price controls always leads to scarcity.

All around inflation is always a monetary phenomenon. The government should address that instead of looking for a free lunch. Policies cannot control free markets – its a chimera!

India, in some respects, may be headed down the same inflationary path, with everybody urging for a easier credit policy.

On a different note (& post!): The Fiscal Cliff is a non-entity and will be resolved and things will move on, although the Stock Markets would jump as if it was a great revelation! – Dec 12, 2012

The stock market has done that and the euphoria is now over. Its a long ride back home, with more rate cuts on the way! The rate cuts won’t do much except stoke inflation. There is no such thing as a free lunch!

Have we run out of ideas?

Someone asked me a surprising (at least to me!) question recently. Is the quality of innovation in the World coming down?

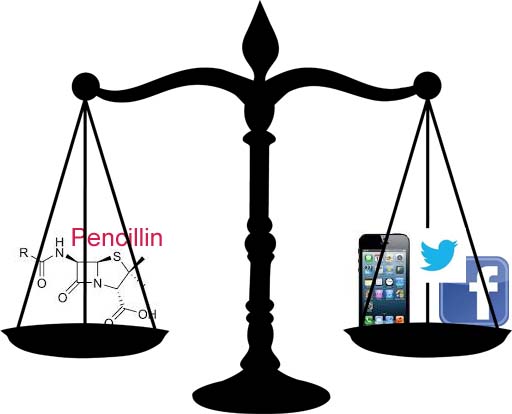

It is true that in the last 100 years, humans have made more scientific progress than in the last 1000 years combined. From Internal Combustion Engine, Pencillin, Telephone, Television to airplane.

Compare that with the top innovations of this decade: iPhone, Facebook, Twitter?

How would Steve & Zuckerberg stack up to the Wright Brothers or Alexander Fleming?

What is your opinion?

Wheels of fortune!

Mysore is about 130km (~80 miles) from Bangalore. Almost a sister city, except that it takes 3 hours to travel by road or rail! The fastest train we have takes about 2 hours to cover the 130 km and the slowest one takes a tad over 4 hours to cover the same distance.

These are the British era wheels! Overworked, abused, but never upgraded! Transport is the engine of commerce. Any long range road or rail project sharply boosts the GDP – initially because of the investment in the infrastructure and subsequently because of the increase in commerce.

China knows this. Just consider the newly launched high speed train from Beijing to Guangzhou, the world’s longest high-speed rail link. “The 2,298-km line cuts the journey time from more than 20 hours to around 8 hours and connects 28 cities”.

We have too much government, but not enough grey matter or will to stem corruption and move the country forward. That, however, doesn’t stop us from making vocal calls to our neighbors to become under-developed as well!!

Theirs is the wheels of fortune. Ours, the politics of despair!

The Coming Asian Job Cliff

While the world waits with bated breath for the US Fiscal Cliff, a lot of economic changes that would impact India and China in the next 5 to 10 years are underway. For the record, the Fiscal Cliff is a non-entity and will be resolved and things will move on, although the Stock Markets would jump as if it was a great revelation!

Quietly, but steadily, manufacturing jobs are returning to America. The “Made in USA” tag is making a comeback! The only difference is that the factories are automated 90% or more.

What does this mean for India and China in the next decade – countries that rely heavily on “human capital” and exports? Without forward thinking and vision, this would of course be, bad news. Already the cost of doing business in India (wages in IT/BPO, Real Estate costs) are driving a lot of MNCs to places like the Eastern Bloc, Philippines and Mexico. Insiders see a lot of companies that rely on export seeing huge layoffs and retrenchments. Loss of jobs amidst a slowing economy is not good for India’s fragile social fabric.

In balance, China might be better off (in spite of its property bubble). A big lead in infrastructure and a well oiled domestic economy will help it move forward – possibly with domestic consumption absorbing the slack in exports.

On the other hand, India with its blinkered politicians who cannot envision anything more than the next election, would be hard hit. If nothing is done to create better infrastructure, reduce corruption and make it easier for businesses to do business – all of which grow the economy and create jobs, expect to see more of riots, division in society on many lines, violence and crime.

Contrary to what sections of India Inc and PC want RBI to do, lower borrowing costs would create mis-allocation of capital and investment, not growth.

That reminds me, whatever happened to the Family Planning program in India? The “We two, ours two” and later “We two, ours one” slogans on every wall, exhorted for by the GOI? Maybe, another post for another time!

Its like that only!

The road behind!

The early part of the century witnessed a high level of economic prosperity, made possible by exceptionally favorable conditions. Its liberal economic policy, which guaranteed freedom of action and an organic growth on the lines of “laissez faire” lead to growth, employment and prosperity.

Later day populist policies which included distributing free food to all citizens, free entertainment, free medicines and a host of other measures put a strain on the state’s finances. This led to higher taxes and the misallocation of capital from job creating investments to extravagant consumption.

In the face of social agitation towards higher taxes, it was easier for the State to instead debase the currency. Started at just 5%, it continued till the cumulative debasement added to more than 75%. Although, in the initial stages it spurred economic growth, leading to more social infrastructure projects and generally gave the impression of prosperity, the debasement ultimately led to poverty and severely reduced the government’s real revenue.

In face of falling revenues, the governments tried to debase the currency even more. This lead to rampant inflation and spiraling prices. In face of rising prices and civil unrest, the government put in price controls on food and other supplies deemed essential. This led to hoarding and scarcity of goods.

If the story so far sounds familiar, it is because history repeats itself. Over and over!

Still, the mob in power and the palace favorites while producing nothing, yet continually demanded more, leading to an intolerable tax burden on the productive classes. In the end, there was no money left to pay the army, build infrastructure, or protect the frontier. The barbarian invasions, finally led to the fall of Rome.

The ponzi banks of India – 2

This is a follow up to the earlier post: The ponzi banks of India

A recent news article on ET screamed “Bad loans of state-run banks are Rs 1.43 lakh cr as of Sept“. Is that about $30 billion?

The bad news is that the number is seriously under-stated (as is the norm with all state run banks, which state what the State wants them to state!).

Here is SBI 2012 Financials – courtesy Money Control

Check out the last 3 rows. Do we see something about 600000 crores in CL? and 2L crores to be spent to collect it, assuming it can even be collected? That is just for SBI! Now, add other big Public Sector banks like PNB, BOB, SBM, etc and you begin to get closer to the real picture.

We don’t know where all that money went, but King Fisher took 2000 crores. Various IPL franchise teams took several thousand more. There were some industries run by the family members of top politicians that took some! So, I am sure it all adds up.

What is certain is that GOI (aka Tax Payers) will be “recapitalizing” these banks. SBI has already approached the government to raise about 1L crore! Compared to this, Big Ben positively looks like a miser with the printing press!

If that depresses you, you are welcome to watch the “King Fisher Calender Girl Hunt 2013”. SBI shareholders get a free pass!

The race to the bottom!

“The China-India business relation has matured in the last decade but a wide trade deficit in favour of Beijing needs to be addressed by Beijing for the relationship to develop further”, Indian ambassador S Jaishankar has said.

I was stupefied when I read this. Here is the original link, in case you are equally shocked! It is like the dumbest student complaining that the class topper should score less “for the relationship to develop further”.

“If the trade deficit comes out a perception of unequal market access, frankly it is not good for the relationship because it does not give an impression of a fair relationship” the news article goes on to add.

Sure, lets us race each other to the bottom. I honestly wonder how such thoughts are conceived, especially in the corridors of power where decisions have big impacts.

China has solid, well planned infrastructure, solid network of roadways and high speed rail and a strong will to further it. All this has been achieved in the last few decades. Sure, there is a price to pay for it, but looking around India, one may be forgiven for thinking it is not too high a price.

Now, instead of trying to replicate the good work here, within an Indian context, we want to dumb down our neighbor to our level.

Its like that only.

The ponzi banks of India

It comes as no surprise that S&P had downgraded SBI. Even with accounting gimmicks, its NPA still stands at 5%. Its Mar 2012 SEC filings show contingent liabilities (liabilities that may be incurred in the future) at 698,064 Crores (that is right folks, over 6 lac crores!).

Not only SBI, but a host of other banks have huge exposure to loans that will never get repaid (SBI, for example, has 1800 crore loan to Kingfisher, which is pretty much closed). Not only this, many political biggies use the PSUs as their personal cash cows. Getting them to disburse loans that will never get repaid!

Year on year, with creative accounting they show profits while writing off loans and asking the government for every increasing “capitalization”

Recent News:

SBI group requires Rs 1 lakh cr to meet Basel-III norms

PNB to undertake Rs 2360 crore capital infusion

IOB needs 1500 crore infusion this fiscal

Google and you will find several more. In summary, most of our banks are bankrupt. The profits & dividends seem to come out of the deposits collected, making it one big ponzi scheme. The government itself is running a huge deficit, so where is this “capitalization” money going to come from? That’s right, printing! Run the presses, never mind the inflation or the currency debasement!

While the world looks with bated breath on the money printing in the US, our own “M3” money supply is many times that!

Smart graft – the SEZ way!

“New Draft policy allows IT SEZ developers to exit” reads Deccan Herald. While we are used to a few “political class” dipping their fingers in real estate, more insidious and damaging is when things are done as a matter of “policy decision” – that too in the name of development!!

Google can tell you this: In the not-so-recent-past, there was a STPI (Software Technology Park) and 100% EOUs (Export Oriented Units) got IT and other benefits for bringing in foreign exchange and generating jobs. The recently introduced SEZ replaces the STPI after Mar 2011.

Here is the interesting piece: The law on SEZ provides for 100% IT exemption for SEZ real estate developers (Nice! Someone needs to ask PC, why?). Not only that, the actual forex earning IT firm, to enjoy the benefits previously accorded to EOUs, should now be physically housed inside a SEZ and submit a 5 year lease agreement with the SEZ developer!! As one might expect, renting spaces in SEZ is not exactly cheap.

The current policy seems to be actually for the benefit of the SEZ real estate developer rather than the businesses that promote exports, bring in foreign exchange and create employment! Add that to the fact that almost all of the new SEZs are owned by the powers that be! If not directly owned, “they have their entire hand not just a finger” as FirstPost put it delicately.

So, in effect the SEZ seems to be an elaborate scheme to make money off of the forex earnings and that too with 100% income tax exemption!

Welcome to the world of smart graft.

The Right To be Ignorant

I have not seen any serious talk against RTE. Anybody who challenges it is immediately branded an “elitist”!! We certainly need to educate everyone, but RTE, in the typical bureaucratic way, gets it ass backwards. Bear with me, while I explain.

Firstly, any sort of government control (without addressing the supply issue) leads to scarcity – we have seen this most recently from Zimbabwe to Greece. Zimbabwe has hyper-inflation from the endless money printing by the government. But the government mandated a “price control” on food. The result? Empty shelves in supermarkets.

Greece, reeling under deficits, set a price cap for how much it will pay for drugs under its nationalized healthcare. Result? Drug scarcity.

“The reasons for the shortages are complex. One major cause is the Greek government, set prices for medicines. As part of an effort to cut its own costs, Greece has mandated lower drug prices in the past year. That has fed a secondary market, drug manufacturers contend, as wholesalers sell their shipments outside the country at higher prices than they can get within Greece.”

The obvious next step for the government would be to ban exports. This would bankrupt the companies and completely close off the drug supply.

Coming back to RTE, I see it as GOI’s way of abdicating its own responsibility and covering its abysmal failure. Whatever happens to the 3% education cess being charged?

Everyone knows that a significant percentage of teachers in government schools are under-qualified and way overpaid. Local governments just treat them as large vote banks. RTE was the easier alternative for GOI than to try and fix this real problem.

The right way to do this would have been to use the tax wisely, clean up the government schools and make them compete with the private schools in terms of quality. So much so, that the Great Indian Middle class would want to send their wards to the government schools (aka. Public Schools in USA). The private schools would then need to find a niche, innovate to stay ahead or go out of business. (If the education cess is not sufficient for this, one can always ask the benevolent new members of the parliamentary committee to provide aid!!)

And oh, if you thought it’s a pipe dream, you would be mistaken! My attention was recently drawn to one such government school in small town India. The nearby “private school” had very few children, while the government school was full. When asked, one parent remarked “why would I want to pay when I get better education, free books & free uniforms next door?”

While giving us the Right To Education our political powers firmly retained the Right To be Ignorant.